For over a year I have warned against investing in municipal bond funds, because I believed that there would be some fallout from the credit crisis affecting this market segment as well, which turned out to be correct.

For over a year I have warned against investing in municipal bond funds, because I believed that there would be some fallout from the credit crisis affecting this market segment as well, which turned out to be correct.

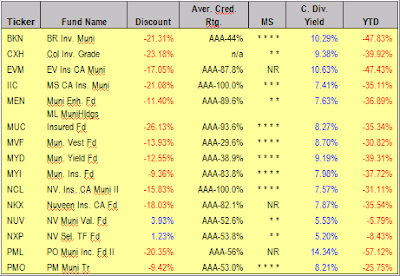

The weekly table in section 7 of my StatSheet (see table above) clearly showed that most of the muni funds I track have lost sharply. To me, it has never made much sense to invest for a good yield yet at the same time lose big on the principal side.

On that subject, Bloomberg reports that “Pimco Muni Funds Down as Much as 60% to Buy Auction Shares:”

Pacific Investment Management Co. plans to redeem preferred shares from six closed-end municipal bond funds that lost as much as 60 percent this year.

The Pimco funds, which plummeted after suspending dividend payments to common shareholders, said yesterday they will redeem $407 million in auction-rate shares next month, after declines in the municipal market drove their holdings below minimums relative to the amount of money they’ve borrowed.

Plunging debt prices have pushed closed-end funds to defer dividends and reduce borrowing to comply with U.S. securities law. Funds that issue preferred shares are required to maintain net assets of at least 200 percent of the amount of leverage. Municipal-fund investors are likely to show little patience for those that miss dividend payments, said Jeff Laverty, a closed- end fund analyst at Oscar Gruss & Son Inc. in New York.

“That’s the reason they’re in these things: to provide current income,” Laverty said.

The funds are Pimco New York Municipal Income, Municipal Income Fund II, California Municipal Income Fund II, Municipal Income Fund III, California Municipal Income Fund III and New York Municipal Income Fund III.

Closed-end funds, unlike the open-end variety, issue only a fixed number of common shares that trade on an exchange like stocks. Investors in the funds have suffered a series of blows this year that have pushed share prices to record discounts. In February, the auction-rate market collapsed, eliminating a source of new financing and leaving holders of preferred shares unable to sell. In recent months, falling prices on the bonds in their portfolios have forced the funds to cut their borrowing.

Pimco, a unit of Munich-based Allianz SE, announced the dividend suspension on its municipal funds Dec. 1.

“When Pimco suspended their dividends on six of their municipal funds because of asset coverage issues, their share prices tumbled,” Cecilia Gondor, a closed-end fund analyst at Thomas J. Herzfeld Advisors Inc. in Miami, said in an e-mail earlier this week.

The average return this year for municipal bond mutual funds tracked by Bloomberg has been a 14 percent drop. The six Pimco closed-end funds were down about 49 percent to 60 percent this year, placing them among the nine worst-performing funds in their class, data compiled by Bloomberg show.

Investors have shunned lower-rated securities in recent months, making it harder for municipal funds to find buyers for higher-yielding tax-exempt debt in the secondary market. Among the Pimco funds’ top holdings were securities backed by U.S. states’ and counties’ tobacco-settlement revenue, according to Bloomberg data.

Merrill Lynch & Co.’s total-return index of municipal tobacco bonds has lost 17.3 percent this year, the worst since the 1998 settlement with cigarette makers opened the door for the securities.

[emphasis added]

Those investors who mistakenly assumed that tax-free investing in Muni Funds, or any income funds for that matter, carries less risk than equities, have been bitterly disappointed by seeing their portfolios slashed in half. The lesson simply is that there is no investment in existence that you can assume to be safe from severe market declines.

So, let me play that same old song again to “never, ever invest in anything without an exit strategy.” I have been harping on this since the last bear market wiped out fortunes; unfortunately, I still have not been able to get the message across to everybody on Main Street America. If you’re reading this, and agree with it, please pass this blog and newsletter on to family, friends and co-workers.

Contact Ulli