Every time the market makes a new low, you hear someone declaring a bottom followed by some wild explanation as to why a turn-around to the upside is imminent and good times are lurking around the corner.

Furthermore, opinions abound why this very moment in time would be a good one to pick up a stock that is considered cheap given historical data. While this kind of bottom picking may work during temporary reversals in a bull market, different rules apply when the bear strikes with full force.

Many in the investment world (including so called professionals) haven’t caught on to that fact and are following bullish strategies while getting their head handed to them on a silver platter. There is a penalty for ignorance, and it usually manifests itself in the form of a severe portfolio haircut. The funny thing about that is that the bear does not discriminate and wreaks havoc on $50k portfolios with the same force as it does with those in the range of billions of dollars.

I was reminded of that when I read billionaire Kirk Kerkorian’s latest clash with brutal reality when one of his investments in Ford so far ended up with a loss of some $700 million in only four months.

MSN Money reported it as follows:

Kerkorian’s Tracinda Corp. bought 100 million shares of Ford in April at $6.91 a share. He bought another 20 million shares at $8.50 and added 22 million shares on top of that at $6.54. Total investment: $1.007 billion.

He realized $17.7 million on this week’s sale. Ford was selling for $2.22 a share Tuesday morning, which means Kerkorian’s remaining stake is worth $317.4 million. So, combining what he did sell with the market value of what’s left, his loss is now $689.4 million — 68.4%.

In fact, 2008 has been very very bad to the 91-year-old financier. His net worth was estimated at $11.2 billion by Forbes magazine in September; it’s now much less than that.

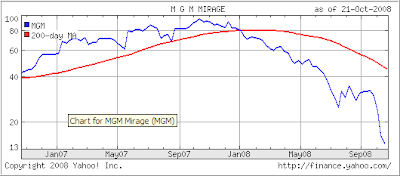

Shares in his best-known holding, MGM Mirage, have fallen 85% in the last year, cutting the value of Kerkorian’s shares from almost $15 billion to $2.2 billion — a loss of $12.7 billion. MGM Mirage is Las Vegas’ largest casino company, ranked by hotel rooms. The problem: a weak economy that has slammed business in Vegas.

Plus, his stake in Delta Petroleum has fallen 68.3% since December 2006, leaving Kerkorian with a loss on paper approaching $752.9 million. Worse, as the New York Post noted, he had to put all those shares up as collateral five months ago to get a $600 million credit line from Bank of America. The problem: falling oil prices.

But at least he could get a credit line.

These numbers add up to mind boggling losses. I think Mr. Kerkorioan and his team need a lesson in simple investment basics how one can protect himself from devastating losses via sell stops or simple trend following.

Otherwise, why on earth would you still hold on to an investment like MGM that has lost 85% over the past year? Take a look at the chart:

Now tell me, if you’ve been following trends for a while, at what point would you have sold? High 70s or thereabouts would not have been too difficult a point to detect a directional change at.

As this bear trend progresses, you will find more stories like these where brand name investors will give back billions of their assets by simply betting on the wrong horse or being way too early. Granted, there is always a chance that via random luck someone may hit a home run, but that will have nothing to do with investing but everything with gambling.

Trends will eventually reverse again and for you to successfully grow your portfolio, you don’t need to be in at the exact bottom. You’ll be better off waiting for a real bottom to form before committing your money so that the odds of a continued rally are stacked in your favor.

Comments 2

Ulli,

Discipline is the king and I am afraid, trend or no, most of us wind up being too greedy wanting that absolute bottom. Did yu manage to adopt trend following only after severe losses getting back in too early or just teriffic self discipline.

Back in the 80s, I saw others doing this successfully, so I adopted it to my needs. It gave some control over the markets.

Ulli…