While there are not many mutual funds suitable to buy and hold forever, some do better than others depending, of course, on the current economic environment.

While there are not many mutual funds suitable to buy and hold forever, some do better than others depending, of course, on the current economic environment.

Earlier in the year, we started to diversify into Swiss Francs and gold as the dollar continued its descent to new lows. Since many clients have several accounts with me, and some being of smaller size, I opted to invest in PRPFX, which has a variety of hard assets that automatically take care of diversification.

Yahoo Finance describes the profile for PRPFX as follows:

The investment seeks to preserve and increase the purchasing power value of its shares over the long term. The fund invests a fixed target percentage of net assets in the following investment categories: gold, silver, Swiss franc assets such as Swiss franc denominated deposits and bonds of the federal government of Switzerland, stocks of U.S. and foreign real estate and natural resource companies, aggressive growth stocks and dollar assets such as U.S. Treasury securities and short-term corporate bonds.

One reader apparently discovered this fund as well and had this to say:

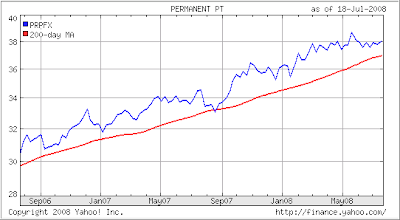

Would you please look at PRPFX? It holds a number of assets and its trend line is always above an upward sloping 50 day MA and 200 day MA. When you look at the 200 day MA, am I correct in saying that you want the MA line to have a positive slope (and not be flat) – indicating increasing stock price?

Would you please tell us what you think are the pros and cons of investing in PRPFX. Many thanks for your wonderful service.

The reader is absolutely correct as the 2-year chart shows:

If you are following trends, this chart is as ideal as they come. Low volatility makes this a good fund to have a portion of your portfolio invested in. For the first half of the year 2008, it’s up +5.19% vs. the S&P; 500’s loss of over 12%.

Over the past 12 months, it has not come off its high by more than 5.20%, which occurred on 8/16/07 and means a trailing sell stop would have never been triggered. Of course, trends can reverse, but should you decide that this fund is a worthy addition to your portfolio, be sure to use my recommend exit strategy.

Comments 1

Ulli, I have owned this fund for a year and the investment manager seems to be excellent. You may not like this idea, but, I leverage it 50% by using margin since current margin rates at my broker are 4 1/2%. (Trade King).