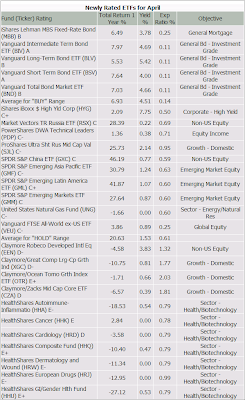

TheStreet.com featured coverage of 37 new ETFs including a ranking which combines risk and performance data combined into a single composite opinion represented by a letter. Here’s a partial view of the table featured:

double click to enlarge

I have been tracking some of these in my weekly StatSheet. The problem with the type of rankings featured here is to find a proper entry point. Let’s take a look at some snippets from the story:

With an initial rating of E, investors in the HealthShares Ophthalmology ETF(HHZ – Cramer’s Take – Stockpickr) are seeing red after losing 40.20% in a year. Over the same period, the holdings providing the worst of the damage include ISTA Pharmaceuticals Inc(ISTA – Cramer’s Take – Stockpickr), off 77.25%; LCA-Vision Inc(LCAV – Cramer’s Take – Stockpickr), off 75.12%; TLC Vision Corp(TLCV – Cramer’s Take – Stockpickr), off 74.70%; and Opko Health Inc(OPK – Cramer’s Take – Stockpickr), off 65.21%.

Also, speculators expecting fat returns from the E- rated HealthShares Metabolic-Endocrine Disorders ETF(HHM – Cramer’s Take – Stockpickr) ought to be roundly disappointed with a loss of 36.55%. The one-year loss of 89.61% from Nastech Pharmaceutical(NSTK – Cramer’s Take – Stockpickr), 82.12% loss in shares of MannKind(MNKD – Cramer’s Take – Stockpickr), and 72.18% drop in Altus Pharmaceuticals(ALTU – Cramer’s Take – Stockpickr) contributed most to the investor account shrinkage.

As you can see, this is volatility and losing money at its finest. If you like gambling, this is for you. Jumping into these types of ETFs without use of sell stop points can expose you to losses of some 80% although, in all fairness, some funds like GXC gained some 46%.

Nevertheless, following any ranking scheme blindly, will expose your portfolio to gigantic losses probably more often than huge gains. Keep in mind that no matter which investing approach you prefer, the entry point is important, but the exit strategy will save your bacon.