Al Thomas, author of “If it doesn’t go up, don’t buy it,” made these market observations titled “Humpty Dumpty Market” in his last weekly update:

Al Thomas, author of “If it doesn’t go up, don’t buy it,” made these market observations titled “Humpty Dumpty Market” in his last weekly update:

….and all the King’s men could not put him back together again.

Our king is supposed to be Fed Chairman Ben Bernanke. Did you have the opportunity to listen to his testimony before Congress this past week? From his statements it doesn’t look like he has any idea how to put the pieces back together again.

The King’s men (Senators) were asking some hard questions.

The king had some soft answers.

“Yes, Senator Know Nothing, we are looking into that…, Well, Senator Upside Down, our staff expects (so & so) to happen, but we will have to wait and see…, Senator Big Spender, most economists agree that …, Senator Hardliner, we will put your concern on our list of issues …,” Da dah, da dah, da dah.

The king had no solution for the current crises.

To give the King a little slack it must be admitted he did not cause the problem. His predecessor, Sir Alan Greenspan, created the problem and stepped out in time to let the next guy get the blame.

The credit problem is so huge it has become worldwide.

The king’s men want to seem they are interested in fixing it, but all they are doing is giving the illusion of concern. Their main concern is getting reelected so they have to look like they are doing

“something”. Most of them do not fully understand its complexities.

The solution is one no politician will ever agree upon. And that is to do nothing and let the banks and creditors sort it out. If that were allowed to happen there would be major bank failures all over the world. A huge bank in England has gone belly up and had to be “nationalized”. About 2,000,000 people in the U.S. would lose their homes. The auto industry would come to a halt. Even the credit card companies would be in serious trouble and hundreds of thousands if not several million, people would be forced into bankruptcy.

The depth of this credit problem was beyond all expectation. The cheerleaders on CNBC-TV will not tell you. Your broker won’t tell you. You financial planner won’t tell you. Wall Street and Washington don’t want you to know. The little investor is hung out to dry.

The stock market is telling everyone right now. It is going down with no bottom insight. The small investor is not advised to sell his stocks or 401Ks and go to cash. That is his only personal protection.

It will take a long time to put Humpty Dumpty (otherwise known as Mr. Stock Market) back together again. It will happen.

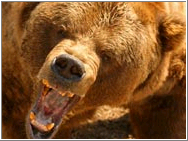

In a bear market there is an old and true statement, “He that loses the least wins”.

A smart investor will not let his retirement portfolio become one of the Humpty Dumpty broken pieces. He will sell now.

Whether you agree with Al or not, he sure calls it as it is. My personal view is very much the same and, despite the lessons taught by the last bear market, many investors are on track to repeat the same mistakes. How do I know? Based on the e-mails I have received I have to wonder if some readers of my newsletter simply view it as another source of entertainment, like CNBC, to be listened to and not acted upon.

Comments 2

Ulli,

This is not a scientific approach but in my view the mere fact that you are not a regular guest on CNBC greatly increases the probability that you should be listened to and, quite possibly, acted upon.

I used today’s irrational market behavior to start a position in SOPSX. May the QQQQ’s fall after Wall Street realizes a $200B Fed loan with junk as collateral isn’t going to shore up an $11T problem.

G.H.

The Fed is merely attempting to unlock a jammed market and we can only hope that they will succeed. The deminensions of the problems in the financial market are to a larger measure a result of an accounting convention know as mark to market which makes only sense in a highly liquid and efficient market. Once a market jams, mark to market account perpetuates a downward spiral we are seeing today.