Recently, a reader mentioned that he was using my M-Index to pick bottom of the barrel ETFs, namely real estate related beaten down indexes. My personal preference is to buy ETFs that are on the way up and not trying to catch the proverbial knife.

Recently, a reader mentioned that he was using my M-Index to pick bottom of the barrel ETFs, namely real estate related beaten down indexes. My personal preference is to buy ETFs that are on the way up and not trying to catch the proverbial knife.

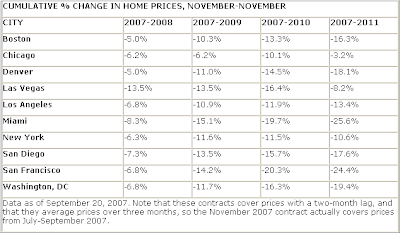

Especially, real estate appears to be the next super bubble, which may take many years to unwind. Case in point is the Chicago Mercantile Exchange’s (CME) extension of the futures market on the S&P; Case-Shiller Home Price Indexes from one to five years. Now, futures investors can make bets on where home prices will be as far out as 2011. Matthew Hougan of Index Universe featured the gloom and doom tables along with their estimated percentage change in real estate prices on the most recent futures sale on the CME:

Matthew makes 2 important points:

1. Read that chart carefully. Over the next 12 months, traders expect prices to fall in each of these cities by 5-13%. By November 2009, prices will be down more than 10 percent in every city save Chicago. By November 2010, prices will be down 20% in Miami and San Francisco, and 15%+ in San Diego, Las Vegas and Washington, D.C. It gets worse in 2011.2. As a point of emphasis, remember that these are priced in actual dollars and do not take into account inflation. Factor in 3% annual inflation and the real value of these homes falls a further 11.5% by 2011, putting prices in Miami and San Francisco down 37% and 36% respectively on a real-dollar basis. Who said house prices never fall…

Of course, there is no guarantee that this will actually happen to the exact degree, because traders are notorious for being wrong. However, my feeling is that there is certainly some validity to this down trend given what happened with the dot com bubble, which took years to unwind.

Additionally, since real estate demand was artificially inflated with the help of subprime borrowers, which have now been eliminated, you have to wonder where the next driving force will come from.

Comments 4

Ulli, I went back and re-read your article titled “The Real Estate Confusion” from Saturday, January 27, 2007.

Are you now saying that all real-estate related investments are subject to the residential real-estate recession, including commercial oriented REIT’s?

What’s interesting is that at the time you posted that article the momentum tables were showing REIT’s strength at the time. And you do know what would have happened if anyone had invested in REIT’s at that time? They peaked about 10 days later.

Is today’s article a warning to avoid real-estate issues of any kind? REITs are heavily weighted with self-storage and, as this is my business, it will be in a very good position to benefit from all the folks that are walking away from houses they can’t afford to live in anymore.

G.H.

G.H.,

No, it was not meant to be a warning to walk away from all real estate. It’s my opinion that trends need to be tracked to identify any worthwhile investment. Residential real estate, which this blog post referred to, has been on a slide ever since we were stopped out of our VNQ positions on 3/6/07.

My suggestion was to stay away from bottom picking by using the most negative M-Index numbers. There are great opportunities in up trending ETFs; why mess with the downside and the gamble on a rebound based on pure speculation?

Ulli…

I see, so by focusing too much on m-index changes at lower levels, even though a particular fund may be rising, and not looking far enough over to the right side of the tables, to 8wk, 12wk, and DD figures, I have allowed myself to drift into speculation. A fund with too much “red” in it’s row is still too foggy to see it’s trend clearly, so to speak.

And to correct this error I need to be more focused on funds that have all blue in their row, right?

So, for example, based on the 092707 etf master list, possible good choices for new money this coming week might be FXE or KXI?

G.H. – trying…

G.H.

Well, you’re still way down the ranking list with FXE and KXI. I have invested new money over the past month in SLX, EEB, and EWH just to name a few. The key to using top performers is, as always, the strict use of a sell stop.

By the way, the first listing of FXO obviously contains incorrect data and should not be used.

Ulli…