I’ve come across several articles with somewhat different views about the Eastern European emerging markets and how to invest in them. Some of the countries I am talking about are Russia, Poland, Czech Republic, Hungary, Turkey and others.

I’ve come across several articles with somewhat different views about the Eastern European emerging markets and how to invest in them. Some of the countries I am talking about are Russia, Poland, Czech Republic, Hungary, Turkey and others.

Random Roger, in a recent post, had a cautious warning about a possible crisis in Hungary, Kazakhstan, Russia, Ukraine and Estonia because of how they borrowed money while Morningstar’s piece is more focused on the best way to invest in Europe.

There is no denying that one of the top funds over the past few years in this emerging arena has been EUROX.

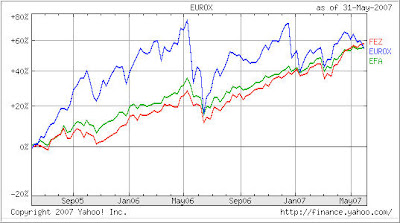

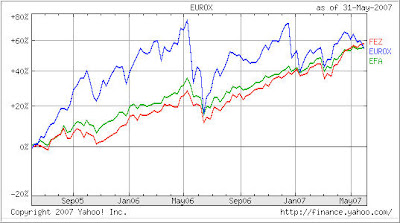

However, it hasn’t always been a smooth ride and the sharp up and down moves can certainly cause you some sleepless nights. To demonstrate, I have plotted EUROX vs. FEZ (DJ Euro Stoxx 50) and EFA (MSCI EAFE) Index in the chart below:

It clearly shows the tremendous difference in volatility, especially when you look at a period of a severe market pullback, which we witnessed during May/June 2006. Obviously, with the subsequent rebound, this fund recovered almost with the same speed as it went down. My point is that EUROX is not for the faint of heart and an exit strategy is an absolute must.

My preference is to use a more conservative approach by being exposed to Europe in general via FEZ (and others) and in larger sense EFA (we have small positions in both, but none in EUROX). While at times it has been profitable to invest in single “Western” European Country funds, I have not done so on the “Eastern” side.

For one, I believe they are too risky at this time and more prone to a severe fall should the overall markets decline. I’m sure there will be more opportunities in the future as ETFS for Eastern Europe are being developed with Russia (RSX) being the new kid on the block.

As always, once they are available, I will track prices first so that I can establish a trend before committing actual dollars.

Contact Ulli

I’ve come across several articles with somewhat different views about the Eastern European emerging markets and how to invest in them. Some of the countries I am talking about are Russia, Poland, Czech Republic, Hungary, Turkey and others.

I’ve come across several articles with somewhat different views about the Eastern European emerging markets and how to invest in them. Some of the countries I am talking about are Russia, Poland, Czech Republic, Hungary, Turkey and others.