Recently, I read a story in TheStreet.com called “Hot Yields Drive Rebirth of Closed-End Funds.”

Recently, I read a story in TheStreet.com called “Hot Yields Drive Rebirth of Closed-End Funds.”

It did a good job describing the reasons for the renewed interest in CEFs. As baby boomers are aging and moving into retirement, the goal seems to be to generate as much income as possible. While 5% bond yields are common and boring to some, 8% to 9% yields are definitely better.

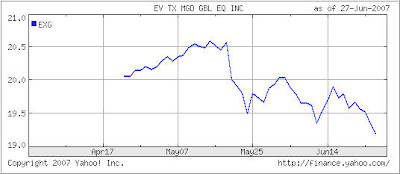

In February 07, the largest IPO in history for a closed end fund was launched raising some $5.5 billion for the Eaton Vance Global Tax Managed Equity Income Fund (EXG), which yields over 9%. That high yield is being generated by investments in domestic and foreign stocks that pay big dividends. Additionally, the managers use strategies such as issuing covered calls, index call options and preferred securities.

Before you jump right in and put your entire retirement savings on the line for this juicy yield, let’s look at a chart of EXG:

Obviously, this fund has only been around for a few months, but the trend has been down so far. To me, getting a great 9% yield is one thing, but losing value at the same time with the fund deteriorating is another.

When hunting for income generating instruments, I like to not just look at yield, but also at a fund’s ability to hold its value. Otherwise, you’re just trading dollars.

While this is not an exact science, it pays in this scenario to have longer term data available before committing your dollars. That way you can analyze how an income fund has performed during various market conditions. You will never find a fund that will fulfill your requirements 100%, but at least you should make an effort to weed out those that may be totally unsuitable.

Disclosure: I have no holdings in this fund.