The Dow made new highs this week, and the dollar hit 26-year lows. What a combination! Without getting involved in the futures market, you can still participate in a rising Euro/declining Dollar scenario.

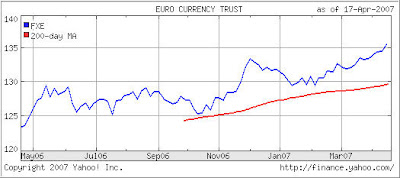

The chart shows FXE, an ETF that tracks the price of the Euro currency. It pays a 2.32% dividend and last year returned slightly over 13%. It’s only been around for some 16 months but it has been very stable during times of market turmoil (May/June 06). The worst DrawDown over the past 15 months (MaxDD%) was a very small -3.27%, which occurred on 7/18/2006.

One of the reasons for that stability is that once currencies enter into a trend, they tend to stay in it for a long time—sometimes many years. While the momentum figures are all positive, you still need to protect yourself with an exit strategy should this market reverse. I recommend using a 10% trailing stop loss point.

I (or my clients) currently have no positions in FXE, but I might consider some exposure. If I do, it won’t be more than 5% of portfolio value.